Employers should adhere to their own policies regarding unused, earned vacation time. While New Hampshire law requires employers that offer benefits to have them in writing, it does not mandate that employers provide vacation time or other benefits.

New Hampshire Labor Laws

New Hampshire Minimum Wage

Nevada has a two-tier minimum wage system. As of July 1, 2021, the minimum wage is $8.75 per hour for employers that provide a qualified health benefit plan, and $9.75 per hour for employers that do not offer such a plan.

The minimum wage rates in Nevada will increase over the next several years as follows:

- July 1, 2022: $9.50 per hour (lower tier), $10.50 per hour (higher tier)

- July 1, 2023: $10.25 per hour (lower tier), $11.25 per hour (higher tier)

- July 1, 2024: $11.00 per hour (lower tier), $12.00 per hour (higher tier)

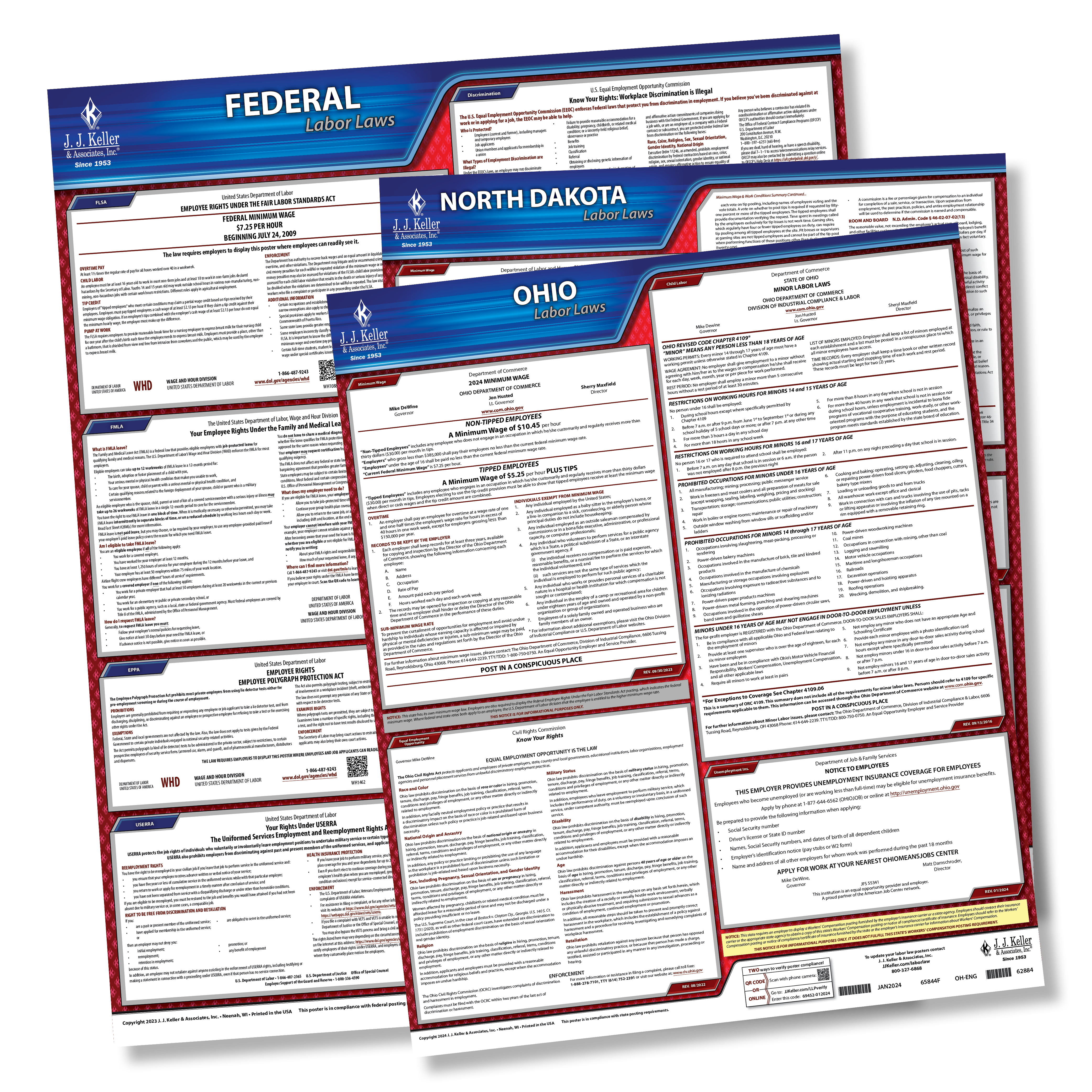

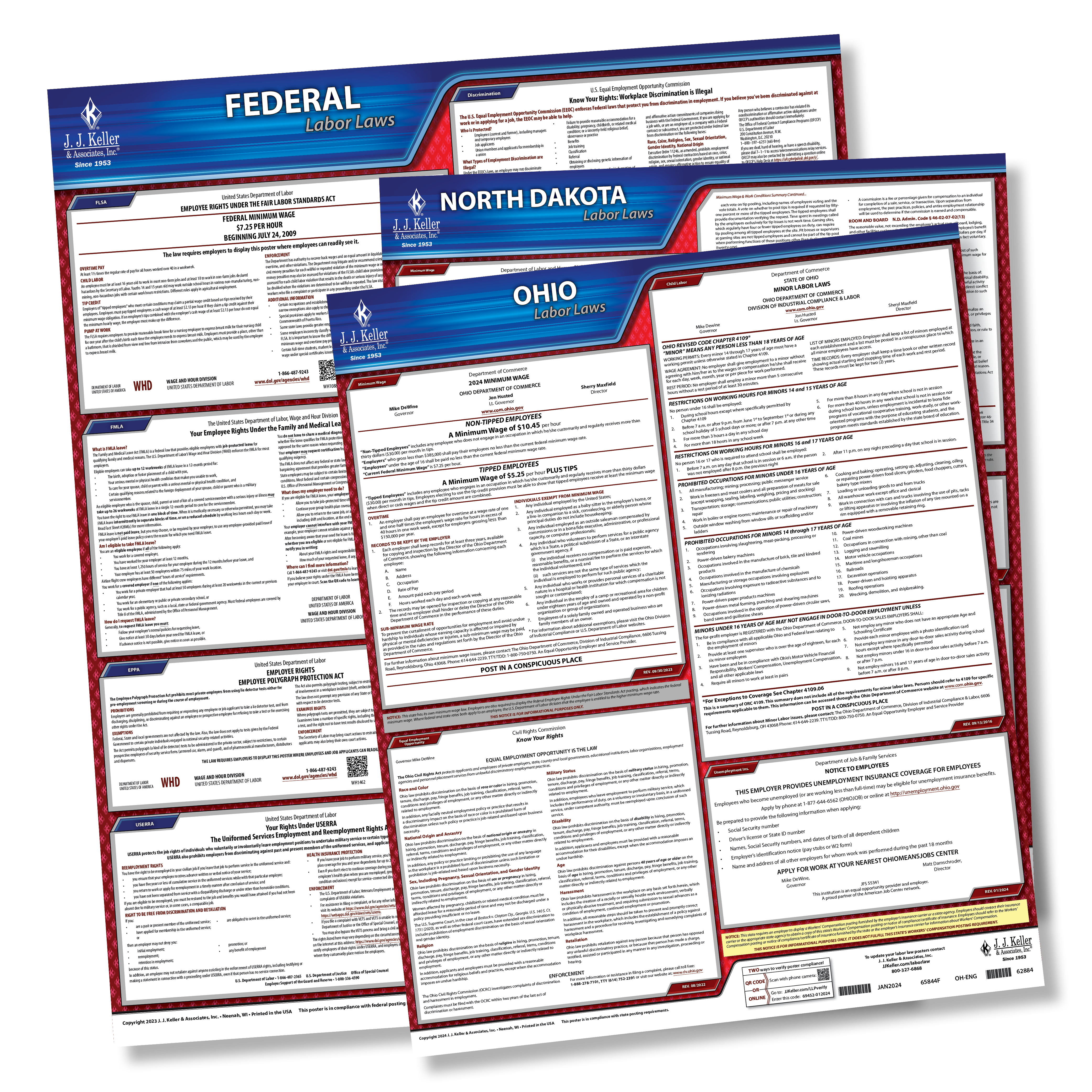

New Hampshire Labor Law Posters

Simplify labor law compliance and make workplace policies visible with J. J. Keller state and federal labor law posters.

History of New Hampshire Labor Laws

Due to the 2006 Minimum Wage Amendment to the Nevada Constitution, employers must provide employees with a qualified health plan to pay them the lower-tier minimum wage rate.

In 2016, the Nevada Supreme Court clarified what it means for an employer to “provide” a qualified health plan. In the case of MDC Restaurants LLC v. Eighth Judicial District Court, the court ruled that an employer does not need to “enroll” the employee in a health plan but merely needs to “offer” the benefit.

In 2018, the court further ruled in MDC Restaurants LLC that an employer must provide health insurance equivalent to one dollar per hour in wages, as the minimum wage rate is reduced by one dollar when a qualified health plan is provided.

Most recently, the legislature addressed the types of health benefits required for employers to pay the lower-tier minimum wage rate. SB 192, effective January 1, 2020, mandates that health coverage must include:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services, including behavioral health treatment

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services (excluding oral and vision care)

- Any other health care service or coverage level required under Nevada law

Municipality Minimum Wage Laws

Nevada does not have any preemption laws regarding minimum wage. This means that cities in Nevada have the authority to set minimum wage rates higher than the state requirement. However, no cities or localities in Nevada have chosen to do so.

New Hampshire Minimum Wage Exemptions

According to Nevada Revised Statutes 608.255, an employment relationship does not exist, and therefore minimum wage does not need to be paid, for the following workers:

- A person with an intellectual or developmental disability participating in a jobs and day training services program

- An independent contractor

New Hampshire Posting Requirements

Required posters:

- Rules to Be Observed by Employers (Wage and Hour Laws)

- Annual Minimum Wage Bulletin

- Annual Daily Overtime Bulletin

- Fair Employment

- Pregnant Workers' Fairness Act

- Nursing Mother's Accommodation Act

- Domestic Violence Victim's Bulletin

- Emergency Numbers

- Paid Leave Act

- Payday Notice

- Lie Detector Tests

- OSHA

- Employee Sick or Sustained Injury

- Unemployment Insurance

- Workers' Compensation

Tipped Wage in New Hampshire

Nevada law prohibits employers from taking any part of an employee’s tips or gratuities or using them toward a tip credit.

Regarding tip pools, the Nevada Supreme Court ruled in 2013 that employers can require employees to participate in tip pools, even if the employees are of different ranks.

Overtime Wage in New Hampshire

The overtime rate is one-and-a-half times an employee’s regular wage rate.

Overtime is required when an employee works more than 40 hours in a workweek.

Daily overtime is required when an employee:

- Works more than eight hours in a 24-hour period, and

- Earns less than one-and-a-half times the applicable state minimum wage rate. As of July 1, 2020, the daily overtime rate is $12 per hour if the employee is offered qualified health benefits and $13.50 per hour if the employee isn’t offered qualified health benefits.

- Note: An employer and employee may agree to a schedule of four 10-hour shifts, in which case daily overtime isn’t required.

Exemptions from Overtime Requirements (Nevada Revised Statutes 608.018):

- Employees not subject to the state minimum wage

- Outside buyers

- Employees in a retail or service business if their regular rate is more than one-and-a-half times the minimum wage, and more than half their compensation for a representative period (at least one month) comes from commissions on goods or services

- Executive, administrative, or professional employees

- Employees covered by collective bargaining agreements that provide otherwise for overtime

- Drivers, drivers’ helpers, loaders, and mechanics for motor carriers subject to the Motor Carrier Act of 1935, as amended

- Railroad employees

- Employees of a carrier by air

- Drivers or drivers’ helpers making local deliveries and paid on a trip-rate basis or other delivery payment plan

- Drivers of taxicabs or limousines

- Agricultural employees

- Employees of business enterprises with a gross sales volume of less than $250,000 per year

- Salespersons or mechanics primarily engaged in selling or servicing automobiles, trucks, or farm equipment

- Mechanics, under certain circumstances

- Domestic workers who reside in the household where they work, if an employer-employee agreement regarding overtime has been reached

- Domestic service employees who reside in the household, if the employer and employee have a written agreement regarding overtime

Child Labor Laws in New Hampshire

According to Nevada’s child labor laws, minors under the age of 16 are allowed to work a maximum of eight hours per day and 48 hours per week.

Employer Recordkeeping Requirements in New Hampshire

Nevada employers are required to maintain records of wages paid to each employee for two years. These records must include the following information for each pay period:

- Gross wage or salary, excluding compensation in the form of services, food, housing, or clothing

- Deductions

- Net cash wage or salary

- Total hours worked in the pay period, noting the number of hours per day (with some exceptions for domestic service employees)

- Date of payment

If an employee requests this information, the employer must provide it within 10 days.

New Hampshire Labor Law Questions & Answers

Yes, small businesses in New Hampshire must pay the minimum wage, which is $7.25 per hour, aligning with the federal rate.

Minors aged 14 and 15 can work:

- 3 hours on school days

- 23 hours per school week

- 8 hours on non-school days

- 48 hours per non-school week

For minors aged 16 and 17, the weekly limit varies:

- During school vacations and summer: 48 hours per week

- When school is in session for three days or less: 48 hours per week

- When school is in session for four days: 40.25 hours per week

- When school is in session for five days: 30 hours per week

Yes, employees must be paid time-and-a-half for any hours worked over 40 in a workweek.

Yes, employees who work more than five consecutive hours must be given a 30-minute lunch or eating period. If employees work during this period, they must be paid for the time.

New Hampshire Labor Law Posters

Simplify labor law compliance and make workplace policies visible with J. J. Keller state and federal labor law posters.